The various other is by the department of the investment bank they operate in, which identifies the sorts of tasks they work with. For instance, a firm might market a whole offering of bonds to a single institutional investor such as an insurance provider or a retirement fund. This can be a faster and less complicated method to raise cash because there is no need to register the placement with the SEC. If the shares are priced too expensive, the public might not want acquiring them as well as the IPO will be an extremely public flop. If the shares are valued also low, the investment banker is leaving cash on the table that could have been generated for the client. When the capital markets are doing well, investment bankers tend to do well.

Throughout the years, Tyler Tysdal has been an owner and managing partner of private equity and venture capital firms, and has actually worked as a business owner raising capital for his own companies at times. He began his career in investment banking working with Initial Public Offerings (IPO`s) and mergers and acquisitions. Tyler has actually worked with the buy-side, the sell-side and as an agent in deals for businesses ranging from $100,000 to greater than $1 billion. As an investor, Tyler T. Tysdal has managed assets and monetarily backed several other business owners. He`s taken care of or co-managed about $1.7 billion for ultra-wealthy families and has helped produce hundreds of millions in wealth for his private equity investors.

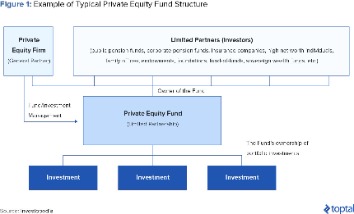

However because these investments are generally independently owned, evaluation encounters many obstacles. Both PE and VC investors bring knowledge and competence to the equation, yet PEs are searching for a quicker turnaround on their investment than an investor, that is willing to wait for the payment. The major one is the problem of raising resources– a challenge that has gotten worse throughout the COVID-19 pandemic. Last regards to the take care of be discussed with lawyers on both sides, as well as the offer will transact, with funds being launched as well as equity being traded. Private equity is money spent by a company or a specific straight into a private company.

MBAs are commonly recruited by investment financial institutions for higher-paying associate positions, as well as worldwide assignments are often readily available for those thinking about working overseas. Extremely couple of mid-career expert transition into the investment financial sector from various other profession areas, yet it is possible – specifically if you have the ability to leverage a background in legislation or among the sciences. Since investment financial entails substantial financial risks and large-scale crises, an investment banker`s work is typically difficult and also demanding. Those employed in the area record average days of fourteen to seventeen hours, regular and often unanticipated travel, cut off weekend breaks, as well as all- night job sessions. Middle-office investment financial solutions consist of conformity with government guidelines and also limitations for specialist clients such as financial institutions, insurance companies, and also financing departments, along with capital flows.

An essential business metric for these capitalists is earnings prior to passion, taxes, devaluation, and also amortization. When a private-equity company obtains a business, they collaborate with monitoring to considerably enhance EBITDA during its investment perspective. A great portfolio firm can generally increase its EBITDA both naturally and by purchases. In the case of private-equity firms, the funds they supply are just easily accessible to certified capitalists as well as may just allow a restricted variety of investors, while the fund`s creators will typically take an instead large stake in the company also. Some are rigorous sponsors or passive investors completely based on administration to expand the business and also create returns. Due to the fact that vendors usually see this as a commoditized technique, other private-equity companies consider themselves energetic capitalists. That is, they supply operational support to administration to help construct and also expand a better company.

The SEC`s authority was developed by the Securities Act of 1933 and also Securities Exchange Act of 1934; both regulations are taken into consideration parts of Franklin D. Roosevelt`s New Offer program. Dodd-Frank needed the SEC to examine the financial literacy of the typical American capitalist. It located that many financiers don`t comprehend the essentials of how the markets or the economic climate work. It additionally makes it easier for business to manage their going publics of stock. Several firms take their stock to the general public markets when they have actually expanded big sufficient to need equity financing for their next phase of development.